Social Update: Millennials and Housing - A Fleeting Dream or a Brave New World?

Do millennials want to own a home? On its face, this seems like a preposterous question, of course we do. Beyond being a significant tax shelter, you don’t have to endure the woes of noisy neighbors, dealing with your housemates’ sub-standard lifestyle, or being obsequious to your landlord’s fickle housing policies. But some experts think there is a shift in behaviors--instead, millennials prefer to live in co-op style living arrangements. Is this interpretation misguided and an artifact of economic turmoil, or indeed a product of our lifestyle preferences?

Figure 1 and 2. Homeownership by Age and Race.

Source: U.S. Census Bureau Housing Vacancies and Homeownership, 2nd Quarter 2016 Release.

Millennials of Color are Less Likely to Own a Home

Millennials represent 23 percent of the United States population. That’s a staggering 75 million 18-34 year olds. According to the U.S. Census Bureau, 34.1 percent of millennials are bona fide homeowners. In comparison to other age groups, however, millennial homeownership rates are unimpressive.

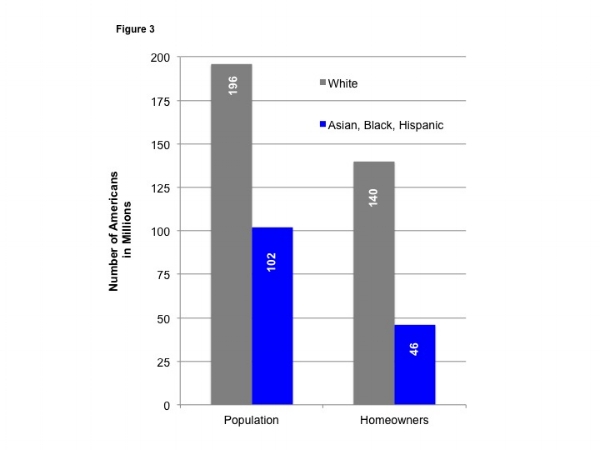

Furthermore, across racial lines, whites have higher rates of homeownership to minorities. While minorities are outnumbered 2-to-1 in terms of population numbers, they are outpaced 3-to-1 to in terms of homeownership numbers.

Figure 3. White Americans Outnumber Asian, Black, and Hispanic American more in homeownership than in population.

Source: U.S. Census Bureau Housing Vacancies and Homeownership, 2nd Quarter 2016 Release.

Clearly there is a disparity in homeownership in terms of age and race. In other words, if you are young and a person of color, you are less likely to be a homeowner. But is this because you don’t want a home? Not exactly. The conundrum emerges when you look at the data from a historical point of view--millennials have delayed purchasing a home. But why?

It Takes Two to Tango

For the first time in 130 years, millennials are more likely to live at home with their parents than to live cohabiting or married. The Pew Research Center points toward two major drivers for this phenomenon: 1) student loan debt and 2) aversion to marriage. According to a survey conducted by the American Student Assistance Organization, student loan debt delays a number of life choices for millennials. It would be surprising to people who support the ‘millennials are not interested in purchasing homes’ hypothesis that 75% of respondents claim student loan debt delays their decision to purchase a home. This alone would upend the argument that millennials aren’t interested in purchasing a home. Perhaps, the remaining 65.9% of millennial non-homeowners are just waiting to get themselves out from underwater before taking on another insurmountable debt. After all, this would be the fiscally responsible decision from the most-educated generation to date. Nonetheless, even if millennials do pay off their student loan debts, the decision to delay getting married or not married at all may be a greater barrier to homeownership.

Lets consider your average single bachelor’s degree carrying millennial that wants to buy a home in California. According to the National Association of Colleges and Employers, the adjusted average starting salary for a millennial is $50,219, assuming they get a degree in a sector that is in demand. According to the National Association of Realtors, the median home price in the United States for an existing home is $217,200. Lets assume this homebuyer qualifies for a home loan under the Federal Housing Administration's first-time buyer program. They may then qualify for a down payment as low as 3.5%. This means they will have to pay at least $7,600 for a down payment. In addition, they will be required to pay closing costs, which in California is about 1% of the home purchase price, or $2,172 in this example. The homebuyer will be responsible for approximately $10,000 at the time of purchase, which is significantly less than non-FHA qualified buyers. Still, the kicker is really in the monthly debt-to-income (DTI) ratio calculation.

This California homebuyer’s net take-home pay is somewhere in the ballpark of $2,100. Next, we have to calculate their estimated mortgage. Using the U.S Mortgage Calculator, the following metrics were taken into consideration, which, unless otherwise stated--represent national averages: CA property tax - 1.1%; interest rate - 5.04%; private mortgage insurance - $180/month; and home insurance - $996/year. The total monthly mortgage payment amounts to $1,583. This California millennial's DTI ratio is 68%: well over the suggested 28-36% range. This doesn’t even begin to take into consideration the basic utilities or consumables, let alone luxury items like Netflix, organic food, and craft beer. Unfortunately, the reality is that affordability comes with a stable two-income household for your average educated millennial. However, with the rates of unmarried individuals growing, it may be a lost cause for millennials looking to become first-time homebuyers.

The ‘millennials are not interested in purchasing homes’ hypothesis stems in part from a huge surge of millennials moving into city dwellings--rents are high, but nightlife is great. Instead, it may be a simple choice between a boring or exciting location. In response, developers are working closely with city planners to create Urban Burbs to attract millennials back. In the coming years, it will be interesting to see whether these Urban Burbs can sufficiently draw millennials back to their parents' stomping grounds and if this resurgence leads to increased rentals or home purchases in these areas. In the meantime, it will also be interesting to see if millennials decide to take a walk down the aisle after paying off their student loans. While homeownership may be a fleeting dream for single millennials, I don’t believe it represents a shift in ideology. The choice to delay homeownership may be in part due to lifestyle-preference, but, to a greater degree, is an issue of economic health. Perhaps a two-income household is a greater driver for homeownership among millennials. Fortunately, there are plenty of dating apps to get the ball rolling down this avenue.